Cryptocurrency Boom — How Do More Asian Investors Influence the Market?

These days, in the cryptocurrency markets, we observe a shift from more traditional Western to newer Asian investors. Just have a look at CoinMarketCap: Asian exchanges make up roughly 50% of the major coins’ trading. The Korean won, Japanese yen and Chinese yuan have become dominant market makers.

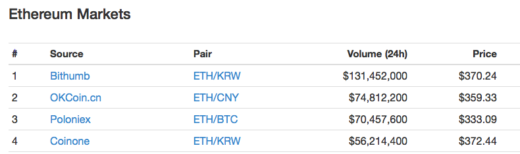

Ethereum with the market cap’s no. 2 spot: three of the four top trading currencies are Asian. (June 23, 2017) | CMC

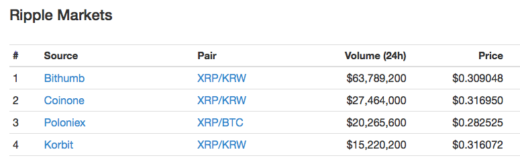

Same with Ripple, the market cap’s no. 3 spot: three of the four top trading currencies are Asian. (June 23, 2017) | CMC

One thing is irrefutable and crystal clear: it’s Asia driving the crypto world.

To start with, don’t even think of objecting with political über-correctness. This topic has nothing to do with prejudice or racism even. It’s a simple observation of market forces and trying to make sense of it.

1. Asians’ tech-savviness

Let’s start this inconclusive list of reasons why cryptocurrencies enjoy such a hype in Asia, and what this means for investments in coins. If you are living in Europe or the U.S., just face it:

Asian countries, especially China and Japan, are light years ahead of Europe and the U.S. in terms of new fintech.

The Chinese government is attempting to build its own cryptocurrency, and the Chinese central bank is actively trying to regulate the cryptocurrency market, which — in the long run — is unavoidable anywhere.

And take Japan where the government has legalized Bitcoin. Bitcoin is official. And what have the mighty U.S. done other than not treating BTC as a currency, but some sort of shady, magical token? Nothing.

You don’t have to be a second Warren Buffet to understand that this alone will mean that Asian investors have more incentive to invest in cryptocurrencies.

Also, mining is mainly done in China, but not because of idealistic investment ideals, but because of cheaper electricity. Leading mining pools burn electricity basically for free, making Asia the natural fertile ground for cryptocurrencies to literally grow.

2. A sheer numbers game

Furthermore, capital controls are tight in most Asian countries, which means that prices can be bumped up dramatically compared to the rest of the world’s exchange rates for crypto coins.

Also, Asians are more of a saving and less of a spending culture. There is a pile of excess capital lying around — why not invest in something new and promising.

Asians have created a lot of wealth in the past decades of hard work and saving up, whereas these days in the West many live on cheap interest rates and are heavily indebted. Add the difference in population sizes. Guess what’s driving the cryptocurrency markets more?

Gambling is related to notions of “luck.” Especially Asian cultures nurture some notions of being able to influence luck to varying degrees. (Image taken from a vintage French postcard showing soldiers gambling in Yunnan province, early 19th century.)

3. Asians’ higher risk appetite

Yes, this hunger for more and more growth opens the doors for hype, pyramid schemes and bubbles. World’s largest casino, The Venetian, is in Macao, China, and long is the list of underground betting and gambling schemes in Asia.

Plus, you don’t have to be an anthropologist to figure out that the Orient has a higher affinity for gambling than the Occident. Many of the illegal global betting mafias are based in Asia. Hong Kong, Malaysia and Singapore are home to the gambling mafia that makes billions with soccer bets.

Observing the sometimes wild trading swings on Asian exchanges with exorbitant premiums suggests that money flowing into the cryptocurrency markets equals a form of gambling.

Add the fact that many punters in Asia act in groups with huge member numbers. They notify all members to pump some coin strong and fast, followed by a brutal dip — because the people who sent out the message have bought huge amounts of coins before and take profit.

Korea, India and Vietnam are samples of this pump and dump action, but less so China and Japan where people have more experience in crypto trading.

Yet, the younger Asian generation investing seems more strategic, calmer. The selling pressure in June 2017 largely came from the U.S. and Europe and some BTC in the U.S. and China. The new American and European punters joining seem to get nervous more quickly, offloading their assets in their late evening hours, just about before Asia started trading.

Conclusion:

Asia has the money and willingness to be the leader for the fintech industry.

The big three’s (Japan, China and South Korea) daily trading volumes is more than 50% of the total. This impact is huge for all coins. It’s Asia pouring cash into the cryptocurrency ecosystem, as opposed to the more conservative and traditional approach by the West.

The cryptocurrency market has been accepted in Asia by regulators and the retail community. They have much larger exposure to the crypto world, so they trade more in it. Yet, the involvement of new, often hot Asian money tends to increase volatility, as much of the funds are speculative.

In a second stage, with more acceptance from regulators and more retail that would use it, market capitalization will further rise proportionally while volatility will somewhat be offset by the East’s and West’s maturing cryptocurrency markets.