Trader’s Manifest

It’s hard not to lose sleep when you’re losing money. But that’s exactly what the successful trader does. He fears loss, but stays above the fear of loss. Then why lose sleep over it.

You want to be a top trader and cannot sleep? You failed the first basic test.

You want to be a top trader and cannot sleep? You failed the first basic test.

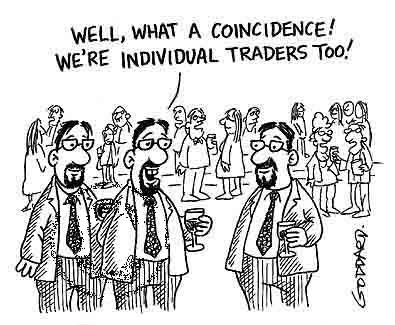

If successful trading would be easy, everyone would be doing it.

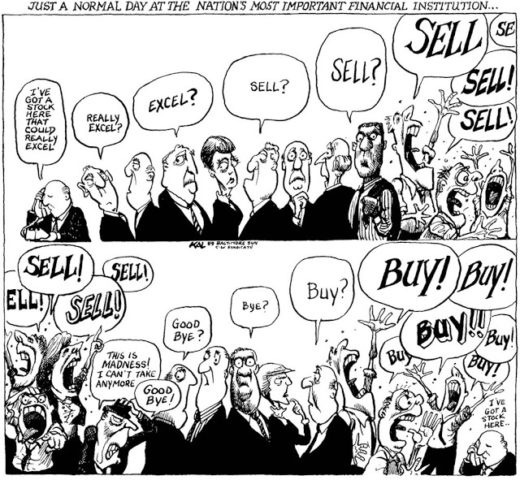

Successful trading is all about psychology. Proper trading psychology is the key to success. The trader’s psychology is what divides the winner from the loser. Doesn’t matter whether you’re trading cryptocurrencies, stocks, bonds. Psychology is key.

How are you reacting under pressure? Your ability to make quick decisions, to think logically, the strength of your character, the emotional quotient of your personality, your philosophical approach toward money — all of these characteristics will determine your probable chances of success or failure in trading. Your psychological make-up is critical.

After you have established a position in the market, will your judgment be influenced by emotion? Are you likely to mistake an emotional decision for a logical one? Will you be foolishly swayed by the actions of others? Conversely, will you stubbornly refuse to listen to good advice?

In trading, emotional problems are even magnified. Your personality, your emotions and your character are tested as nowhere else.

An early warning: if you’re too temperamental, highly emotional and prone to impulsive changes of opinion, then trading is not for you.

You’ll most likely suffer in the early stages already, as losing money is part of the deal of being a trader. Every trader loses money. But the successful ones lose less than others.

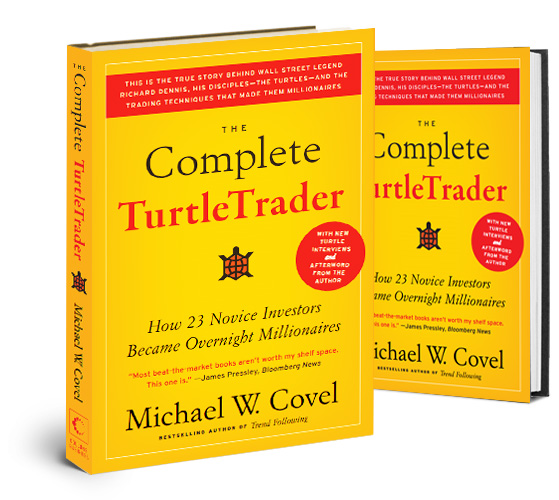

The famous “turtle program” was the fruit of the debate between Richard Dennis and William Eckhardt, on the issue of whether traders are can be nurtured. Dennis believed they can, but Eckhardt thought otherwise. Hence, they decided to make a $1m bet by recruiting people from diverse background and most without experience. The book covers the entire story of the turtles, from the beginning of the program to what happened after the program.

Many tried to track the secret of the successful trader’s psychology. Black-box trader Richard Dennis, the massive bond trader, and legendary futures and commodities trader William Eckhardt, they both wanted to test the “nature vs. nurture” theory: finding out what determines investor behavior.

That’s what the book The Complete TurtleTrader is all about.

Do you have to be born a great trader, or can great trading be taught? Now did Dennis win or lose that $1m bet?

Great traders are born, some say. The urge and feel to gamble is in their genes. When on the floor and trading all week, some of those “naturals” go to Vegas over the weekend to relax and gamble some more.

The success of a trader is less about his trades. The success of a trader is more of an attitude. It’s a lot about emotional control, about not getting carried away.

Also, artists can make very good traders, especially musicians. Musicians see a pattern in music others don’t see. They see a pattern in financial data others don’t see. It’s all about interpretation.

Here’s are the successful trader’s basics. If you don’t feel up to it, better keep your hands of trading.

Self-control

Be able to control the conflicting emotions of fear and greed. These two most human, destructive emotions are always present in the world of trading. Mastering them sets you apart from the crowd.

The third basic emotion is patience. Do not lose your patience, or you will pull out too fast. When you pull out too fast, you lose profit.

Know fear

A good trader wakes up scared of losing everything, spends his waking hours scared of losing everything, and goes to bed scared of losing everything.

The guys that are great traders pick longs that have significant upside. But more importantly they tightly control their downside on the positions that they get wrong.

So fear of the downside is the constant companion of accomplished traders. Anyone who participates in the markets and professes not to be fearful is destined to lose a lot of money.

Know yourself

Top traders stand for passion. They like the action. They live for the thrill and greet every new trading day charged up and ready to play.

They’re daring. You can’t just jump on the bandwagon and follow the crowd. You have to trust your system and forge your own way.

Confidence you need, attitude, and lots of it. You can’t allow yourself be beaten down by losses. You have to be able to pull yourself back up and still believe in yourself and your system.

Confidence you need, attitude, and lots of it. You can’t allow yourself be beaten down by losses. You have to be able to pull yourself back up and still believe in yourself and your system.

Too much self-confidence however is the trader’s and investor’s enemy. Conviction is the attitude the successful trader is aiming for. Conviction is a necessary, but not sufficient condition for successful investors.

Even more critical is the ability to recognize how new data and information and how the price action impacts the conviction of any given position.

It’s human nature, but it’s always difficult to mitigate the inherent bias of your long and short position when you are analyzing new information that comes into the picture. As Keynes once said, “Markets can remain mispriced longer than investors can stay solvent.”

Have a strategy

Key is to try and get the big moves right. The longer term secular trends, as trying to trade short term noise, is way too hard. Find trades that make sense. Work out our entry point. Have a strategy. Know where you add more size to the position, where you dump the position if you get it wrong. And where you exit the position if you get it right.

Your trading plan should consist of stop loss and profit target levels, so that your trade is planned to be taken out early when the market goes against you. And yet there is also a profit target to aim for if the market goes in your direction.

And have you ever noticed how the experts on TV just ape each other and get it so wrong to often? Do your homework, grasp the grading concept yourself, acquire a solid trading background — and outperform those guys on TV.

Keep it simple

Just keep your trading simple. Trying to find a better and more profitable system might only add downward pressure. Too many other opinions and too much fundamentals confuse. If you listen to everyone you can no longer see the wood from the trees. Don’t allow yourself to be confused. If you are looking for miracle information out there to cut losses, then you’re clearly not in the right emotional frame of mind. If you’re not able to realign yourself mentally you won’t get your head back into the profit zone.

It’s a business, stupid

Approach your trading as a business enterprise. Apply orthodox business rules, judgment and money management. Trading is not a game nor a gamble. It’s governed by the fundamental rules of economics.

Know your limit

Not everyone’s a natural. Many great traders learn it the hard way. After many a painful lesson you either quit the stress, suffer a heart attack, or you grow with it, no longer torn down by the loser’s mantra of “Why didn’t I, why haven’t I, why wasn’t I.” The successful trader does not bemoan fictional success.

Over time, to be 7/24 on alert, makes a breakdown highly possible. But it really depends. The best traders eat pressure for breakfast. They trade all week and then gamble for relaxation on the weekend before heading back to start their trading week again.

Stamina is key. Trading is stressful. It’s a roller coaster ride that taxes your brain and your body. You have to have the physical and mental stamina to stay on top of things.

Stamina is key. Trading is stressful. It’s a roller coaster ride that taxes your brain and your body. You have to have the physical and mental stamina to stay on top of things.

Top traders, the best of them, are genetically predisposed to gambling. These people are going to do the same thing for the rest of their lives.

However, there are different traders. The role of a flow trader of market maker is much different to a pure day trader who comes in each morning and tosses a coin as to whether he is going to go long or short today.

If anyone is going to have a breakdown it’s the day trader. Most long term investors realize that you need to be able to emotionally separate yourself from the money you are winning or losing on any particular day.

Don’t think $$$

Don’t think in terms of losing or making dollars, pounds or francs. Think in terms of points. Don’t calculate your profit and losses in terms of hard earned currency. Talk points. You will lose points. The most successful traders lose points. As it is common practice for traders to refer to gains and losses as points. The currency is not the benchmark of our own performance.

You are trading without fear when trading in points. When the real money comes into play you might suddenly find yourself not thinking clearly and trade with fear. The outcome can be many missed opportunities and accumulated losses. Think points, not money, no matter how many contracts you are trading.

Discipline, discipline, discipline

Use discipline when trading, do not trade by hindsight. Ask yourself this: If my next retail purchase is over $1,000, how much research will I do prior to making the purchase. An average shopper will not spend a single dollar without exactly knowing what he or she is spending the money for. Same applies for trading. Some fools are still risking their trades based only on their intuition or feeling.

Know when to run

Know when to cut your losses and run with the profits. That’s a simple concept, but one of the most difficult to implement. It can also be the demise for many a trader. Most traders violate their predetermined plan and take their profits before reaching their target because they feel uncomfortable sitting on a profitable position.

These same people will easily sit on losing positions, allowing the market to move against them in hopes that the market will come back.

Stops are here to be hit, and to stop you from losing more than a predetermined amount of money, or points.

Be prepared to lose

The mistaken belief is that every trade should be profitable. You are doing well if you can get three out of six trades to be profitable. For this you allow your profits on the winners to run, and make sure that your losses are minimal.

The perfect trade is a myth, and you know it. Don’t let fear put you on the sidelines. Stick with your system, believe in yourself and don’t get greedy. If you stop using your system and give in to greed, you’ll hold on too long and risk losing the profit.

Learn from losses

Learn from your mistakes and losses. Look at your positions and strategies objectively. You’re not married to your trades. Traders with a losing position tend to marry their position. Look at the changing factors. Don’t just hope for a turnaround in your favor. Your losses will only accelerate.

You might want to be a passionate and daring trader, but also have to show humility. You have to be able to look past your pride and ego. You can’t afford to cling to a losing scenario because you’re too proud to admit a mistake. Take your lumps and learn from them.

Don’t bet the farm

You ruin yourself by trading much larger sizes than your account. Prudence is key. Do not leverage your account too high. Many traders analyze the charts correctly and place sensible trades. Yet they tend to over-leverage themselves. As a consequence they are forced to exit positions at the wrong time. A good rule of thumb is to trade with 1:10 leverage, or never use more than 5% of your account at any given time.

Utilize only risk capital that, if lost, would not materially alter your standard of living.

See the big picture

Portfolio construction and tweaking the risk-return profile of all the individual bets you have on at one time, and understanding how they impact the broader risk-return profile of the overall portfolio, that is the real art behind investing and the aspect a successful trader enjoys most.

A portfolio is a point in time, a summation of a series of bets on real living organisms (companies, countries, etc.). Key is the understanding how each single bet impacts the profile of the overall series of bets an investor has on at any one time.

Most importantly, the successful trader must really have a broad understanding of all financial instruments and how they interact with one another to construct a portfolio successfully.

Most day traders get crucified as they are just punting stocks and / or currencies. They’re really just playing one part of the companies’ capital structure. What really makes a difference is when you can move up and down the capital structure of a company and buy the senior bonds, subordinated bonds and mess instruments like prefs, converts, etc., in addition to the common stock.

Take a break

A successful trader does not trade all the time. A successful trader will understand that the markets do not move in a straight line. They move in waves. So do you. Know your timing. The trend may be an uptrend, but there will certainly be retracements. Is that a signal to add to positions, to refrain from selling or to just stand still? You have to learn how to judge the market, whether it’s trendy or choppy. Many seasoned traders avoid trading when the market is choppy because it’s too unpredictable.

Experience, experience, experience

Some say if you’ve not been on the floor for at least 25 years you know nothing and are simply not able to trade. As you haven’t seen people panic. As you don’t know what trading is about unless you’ve seen yourself how people lose a whole family fortune within minutes and suffer a heart attack right there on the spot.

What if it’s a scam

What if the whole financial industry promising riches and fortune is set up to lose. What if it’s a scam, as some seasoned traders say. A set-up. As a used car dealer. The mortgage crisis took everyone by surprise? Again, try to see the bigger picture.

Successful trading today is not about economics. It’s about politics. Right, mainstream media talk suggests otherwise. The bigger the lie, the more people believe it? Shall we talk “fake news”? Don’t fool yourself, don’t be blinded. For today’s small day trader the financial markets are poison.

Got all that?

Then you ca relax and peacefully enjoy the beach.