XRP Weekly Report June 5, 2020 – XRP Value Comes From Liquidity

Despite lockdowns and the new normal, Ripple and XRP keep moving ahead. There are signs the eagerly awaited Thai baht ODL (On-Demand Liquidity) corridor is about to move out of the regulator’s sandbox. And why is a former Merrill Lynch broker all in on XRP? And learn why a Ripple pioneer says XRP’s value is tied to its liquidity. (Feel free to subscribe to XRP Weekly at the bottom of the page.)

XRP Market Overview

XRP’s chances to stay above $0.20 are reasonable. Crawling towards $0.21, trading volume is increasing. As the whole market is still enslaved by Bitcoin’s moods and ritual dumps, holding a buying position around $0.19 cannot harm. Overall XRP is neutral, sticking to its sideways channel for more than 1,000 days. Waiting for breakout – yet any market impulse can push XRP north or south.

XRP Preferred Base Currency for Arbitrage

In a blog on May 28, Ripple’s Breanne Madigan, Head of the Global Institutional Markets, makes the case for XRP as the preferred base currency for arbitrage trading.

Amidst the sudden market collapse on March 12, 2020 – what many are calling “Black Thursday” – daily transaction fees skyrocketed to five times the normal amount on Ethereum and Bitcoin’s network, delaying settlements and increasing the price of exchange for currencies between exchanges. During this time, analysis shows that users began shifting to the digital asset XRP for exchange balance transfers.

Breanne Madigan

Even and especially in a volatile market: XRP transactions cost a tiny fraction of a penny and are lighting fast. The token’s “speed, low transaction costs and scalability put the digital asset in a league of its own when it comes to settlement,” Madigan adds.

California Court Consolidates Two Ripple Lawsuits

Law360 on May 28 reports a Californian federal judge consolidating two lawsuits which claim Ripple illegally sold XRP as an unregistered security.

Ripple sought to dismiss the initial suit in September, claiming that all federal securities claims are barred by the statute of repose of three years in federal securities laws. In late February, the judge allowed the case to move forward, but asked plaintiffs to explain more specifically why they alleged that Ripple made fraudulent claims about XRP.

The plaintiffs filed an amended complaint in late March, further alleging that Ripple knowingly overstated the cryptocurrency’s actual utility as a “bridge currency” to facilitate international payments, and claiming that Ripple CEO Garlinghouse touted the product while unloading millions of dollars of the cryptocurrency.

XRP Arcade’s Leonidas Hadjiloizou notes:

This is definitely positive. One less lawsuit to worry about. Don’t forget Ripple asked for the lawsuits to get consolidated along with the main plaintiff.

The judge argued merging the two cases will save time, money and avoid conflicting results. The judge even noted, Leonidas adds:

Based on errant typos in its complaint, it appears that the second plaintiff literally copied, pasted (without formatting), and then deleted numerous footnotes of the first plaintiffs allegations.

Another Swiss Private Bank Announces XRP Trading and Custody

It’s still limited to select private banks, but down the road we will likely be able to store digital tokens the same way we currently store fiat currencies in bank accounts.

Swiss private bank Maerki Bauman on May 29 announces trading and custody of XRP digital asset. Aside, the bank will initially offer trading in the other principal cryptocurrencies Bitcoin, Bitcoin Cash, Ether and Litecoin.

Maerki Baumann is the third private bank in Switzerand to offer digital asset trading and custody, after Sygnum Bank announced full XRP services, followed by Arab Bank announcing a full suite of digital asset services, providing advisory, custody and brokerage. Swiss online bank Swissquote currently offers XRP trading.

Ripple Talks “Institutional Matters” With Brazil’s Central Bank

On May 30, Ripple CEO Brad Garlinghouse and three company executives have a video conference with the Central Bank of Brazil to discuss “institutional matters,” as Cointelegraph reports.

Garlinghouse is joined by Ripple board member Ben Lawsky, Eric van Miltenburg, Senior VP Global Operations, and Luiz Antonio Sacco, VP of Global Operations and General Director for Latin America. On behalf of the Central Bank of Brazil, its President Roberto Campos Neto is assisted by his two top executives responsible for regulation and financial system organization.

So far, Ripple has secured alliances with at least three major Brazilian players – Santander, Bradesco and Banco Rendimento. Ripple’s ambitious plans for Latin America and Brazil in particular surfaced in June 2019, when the company launched its Sâo Paulo office with the aim to expand across the continent.

Ripple Settlements Coming to Japanese ATMs

Ripple partner and investor, SBI Holdings, in its latest financial report revealed plans to integrate Ripple settlements across ATMs by integrating the Ripple-powered settlements platform MoneyTap.

Cointelegraph on May 30 posts a handy video explainer. Should international money transfers be enabled, chances are high they’ll be facilitated through XRP. During September 2019, SBI chief executive and Ripple board member Yoshitaka Kitao stated that the firm was planning to utilize XRP for remittance in the future.

New Liquidity ATHs for XRP/MXN Corridor

Third record day in a row on May 30 for Bitso’s XRP/MXN corridor:

ODL Spotters Rejoice

While your fiat transactions from A to B might take days, sending XRP-powered cash remittances around the globe is as easy as pie.

Around $1 million sent within half an hour on May 31 through the USD/MXN corridor. Total cost? Less than a cent. Plus, of course, the cost structure wrapped around it. Point in case: no more friction to be exploited.

Thai Baht About to ODL?

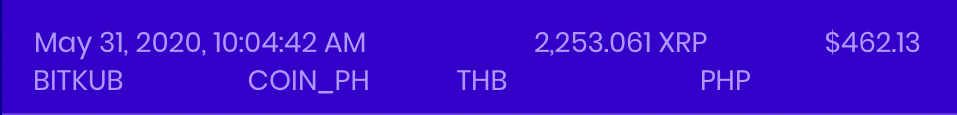

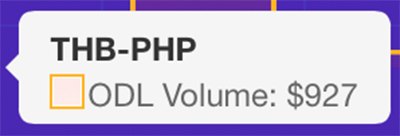

Do Thai Baht ODL corridors finally move out of the regulator’s sandbox into production mode? On May 31, quite a few THB transactions are caught by monitoring website Utility Scan.

XRP/THB live corridor runs through Thailand’s Bitkub exchange liquidity. More and more THB/PHP transactions are popping up. As we know from other new corridors: the money flow literally starts with droplets until the corridor gets traction.

BTC Markets’ XRP/AUD Corridor Pushing to New ATH

May 31, another nice day in the XRP world.

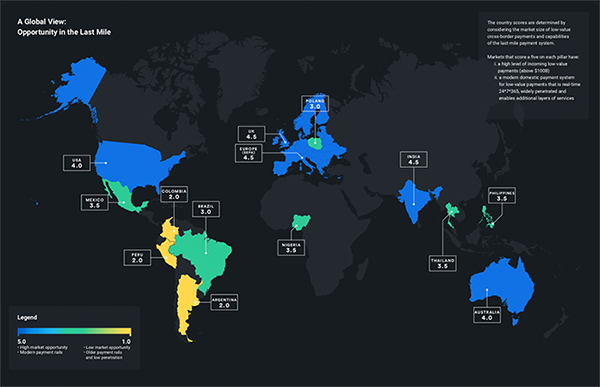

Last-Mile Playbook to Global Payments

On May 31, Ripple publishes its Last-Mile Playbook to Global Payments – a treasure trove to “new opportunities to leverage blockchain technology and grow your business in this country-by-country primer on domestic payment systems.” You can download the Playbook here.

The brochure lists countries of the “last mile” in global payments, a term which refers to the movement of value from a financial institution to the final delivery recipient. This last leg of the payment’s journey is plagued with inconsistencies, due in part to the differing policies and infrastructure, country to country. That’s where RippleNet especially shines.

Listed “Live Countries” are:

- Argentina

- Australia

- Brazil

- Colombia

- Europa

- India

- Mexico

- Nigeria

- Peru

- Philippines

- Poland

- Thailand

- United Kingdom

- United States

What Does Christopher Greene Know We Don’t Know?

Christopher Greene, a turned journalist and former Merrill Lynch broker who got fed up with the old financial system and turned , posts this on June 1, bound by NDA:

Hello Nigeria – and U.K.!

On June 2, Nigeria is spotted on @UtilityScan‘s global ODL map – soon after joined by newcomer U.K.’s Union Jack.

Western Union Offers to Buy Ripple-Partner MoneyGram

Breaking news, based on an anonymous source, on June 2:

MoneyGram’s stock shoots up 30 percent in after-hour trading. No details are yet known. Hope is that XRP could play a role in this newly formed remittance giant. Strategic partne Ripple owns some 10 percent of MGI. More details about the possible merger by Bloomberg.

Western Union so far pretended to be reluctant to use ODL for commercial purposes. If the acquisition proceeds and the three companies cooperate to introduce ODL, the spread of XRP remittance will accelerate.

Ripple’s “Little Bighorn” Growth Hack?

Or there’s no way that… MoneyGram is bait? Which would be called the «Little Bighorn» growth hack. If a target market is difficult to reach, instead of tackling it head on, go after an adjacent market in order to stimulate demand. This tactic was made famous by Facebook.

Back when Facebook was still just for schools, some schools already had their own social networks. Instead of trying to market directly to students at those schools (“but we already have a social network!”) Facebook targeted schools in the vicinity, which would inevitably be home to friends of the target school’s students.

Once all your friends were on Facebook and you’re the last one left standing… it’s kind of hard to say no! Once more and more market players join your network that offers clear advantages… it’s kind of hard not to join!

Bitso Bullish on ODL

In a Pantera Capital conference call on June 2, Bitso CEO and co-founder Daniel Vogel presents an extremely bullish outlook based on the uptake in use cases.

At the end of this year, Vogel says, he will present an enourmous number of crypto-enabled remittance transfers the XRP-enabled exchange handles between the U.S. and Mexico.

In just 12 weeks of operation Bitso is the largest exchange in Argentina. They develop the tech in-house and already attract institutional players.

World’s Top 100 Banks and Ripple

XRP Arcade on June 2 posts a compilation of the world’s top 100 banks with links to Ripple. Currently, 38 percent of the world’s top 100 banks have been linked to RippleNet. Bear in mind, the report says, that there are NDAs in place and banks might be connected to Ripple via other integrators.

Did Someone at SBI Just Blink?

Japan on May 1 enacted new crypto regulation. These regulations benefit those who are established the most – and in Japan SBI is the one. As long-time XRP proponent @TeholBeddictXRP observes on June 2, since the enactment a small number of XRP transactions goes from Bitstamp to SBI VC Trade through their BitGo wallet. Someone at SBI finally blinking with an eye?

For newcomers, a term coined “longest blink in history” refers to Kitao Yoshitaka, Ripple board member and CEO of SBI Group, who mid-2018 famously said SBI’s Virtual Currency exchance SBI VC “will be the number one in the blink of an eye” once the exchange launches. The exchange went live mid-2019.

XRP Pioneer Greg Kidd: XRP Value Comes With Liquidity

In a Digital Asset Investor interview published on June 3, entrepreneur Greg Kidd – one of the first 10 people working at Ripple and an early investor in Twitter and other unicorns – shares some telling Ripple and XRP insights.

Key excerpts:

Kidd has quite an XRP stake. Five years back he took an option for one percent of the entire flow. So here’s an XRP whale holding one billion token.

Kidd reminds us that XRP was the second digital currency after Bitcoin – and you knew who was behind it. It was not anonymous, but a company with people you could join: Chris Larsen, David Schwartz, Jed McCaleb, Stefan Thomas.

Kidd says XRP liquidity is more important than price. The price can only rise if there is enough supply. XRP’s value comes from and with liquidity.

Asked whether Ripple can IPO without a declaration that XRP is no security, Kidd says an IPO would require total disclosure. Yet, securities can become non-securities and vice versa. Even is something is declared one thing today, this doesn’t mean it can’t be declared another thing tomorrow.

Will Ripple make XRP the world reserve currency? Still a long way to go to take over Swift, Kidd says. Ripple is at 2 or 3 out of 10 in terms of how close they are in taking over Swift. Money is still passing through those old legacy rails. A very exclusive club of banks continues to make a whole lot of money out of this friction.

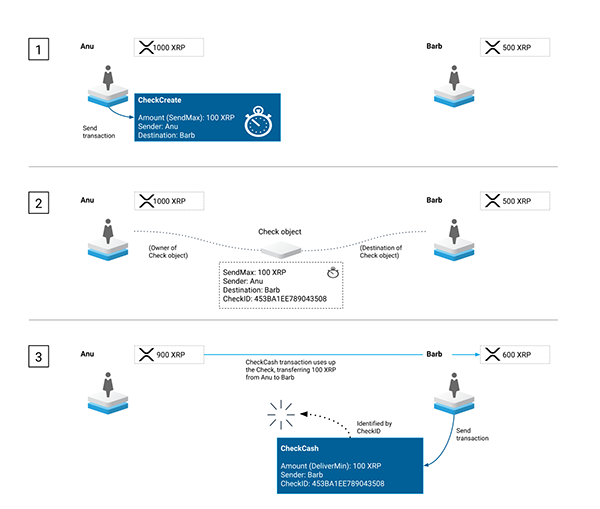

XRP Checks Amendment Proves XRP Ledger’s Independence

As Forbes’ Thomas Silkjær reports on June 3, Ripple Checks amendment is in voting and near the needed 80 percent majority. If enabled, users will be able to send deferred payments that operate similarly to traditional checks, thereby adding more utility to the ledger.

As an example, accounts can choose to strictly reject any incoming funds from transactions sent by unauthorized accounts, but use Checks as an easy way to accept payments and choose to claim or reject at their discretion. This can help in compliance where an entity needs to know the source of funds received.

+++ Update: The amendment is approved on June 4 – without Ripple’s vote. What other clear evidence one needs that the XRP Ledger is independent from Ripple. The two week timer on Checks has started.

MoneyGram Partners With World’s Largest Islamic Bank – Remittances to More Than 200 Countries

On June 4, Rajhi Bank, the largest Islamic bank in the world, announces its partnership with MoneyGram. Tahweel Al Rajhi, the remittances arm of the bank, is to provide money transfer services in Saudi Arabia. Tahweel offers international and local money remittance services with more than 190 centers across the world.

Regarding the new partnership Rajhi Bank says:

We always try to exceed customer expectation by offering them an enhanced value proposition, this time for money transfers to more than 200 countries around the world.

… and This Massive Islamic Bank Confirmed in 2017 They’re Working With Ripple

Just that you know, the groundwork for this deal has been laid since some time. Rajhi Bank confirmed already three years ago on May 13, 2017, they’re working with Ripple:

Al Rajhi Bank (ARB), the world’s largest Islamic Bank, has completed a secure, cross-border money transfer using Ripple blockchain technology. This successful transaction marks the first time the technology has been used in Saudi Arabia.

AUD/USD Corridor Joins the Party

Look who – June 5 – joins the party? The volume was a few hundred dollars a couple of weeks ago.

To the Moon!

Concluding this XRP Weekly with another record high on June 5 for BTC Markets’ XRP/AUD ODL corridor.

Oh Wait, He Needs Some More of His Non-Fav Zerps

June 5 and Christopher Green is buying more XRP.

The next XRP Weekly is published on June 12, 2020. Stay tuned!

If you like what you read, sending a tip to XRP address rLHzPsX6oXkzU2qL12kHCH8G8cnZv1rBJh tag 3130998845 is most welcome! 🙏

+++ Please get in touch if you’d like to share XRP and Ripple news or related rumors, inputs, insights.