XRP Weekly Report May 29, 2020 – Steady ODL Growth

A week that shows several advances of RippleNet rails especially in the Asia-Pacific region, with the rails becoming primed for ODL (On-Demand Liquidity). The XRP flywheel is getting put in place and about to be set in motion. This is what steady progress looks like.

XRP Market Overview

XRP goes sideways mostly for the week, yet follows the broader market’s exploit into May 29 with XRP breaking the trendline and – for a moment – hovering around $0.20. That pressure cooker is sure building up.

Ripple Joins «Heavy Hitters'” U.S. Financial Group

Craig DeWitt, Director of Product at Ripple, announces on May 21 that he’s joining the U.S. Fast Payment Council Working Group, whose members include FRB, VISA, Master Card, AMEX, BONY, etc.

Blockchain.com Adds XRP

On May 21, Blockchain.com announces the addition of XRP to its trading platform. Offering the USD and EUR fiat pairs, Blockchain.com is available in 21 languages, active in 140 countries, trades more than 200 billion dollars annually and has over 40 million accounts.

Does Chris Larsen Fund New ODL Corridors?

In her video on May 22, Crypto Eri speculates that Ripple co-founder Chris Larson might have been moving large volumes of XRP to fund new ODL exchanges / market makers.

Xumm App – “Be Your Own Bank”

Warren Paul Anderson, Head of Developer Relations at Ripple, on May 23 blogs about Xumm app by @XRPLLabs, providing users with the basic tools to “be your own bank,” which include the ability to create accounts, store, send, receive and exchange value, using the #XRP Ledger. Plus there is much more, Anderson explains.

Xumm app is still in beta mode. As per lead developer Wietse Wind the banking application’s version 1.0 is ready in the near future for mass adoption.

EUR/USD ODL Gearing Up

On May 23, some chatter suggests there is a rapid increase in XRP transfer volume between the U.S. and Europe:

A widely quoted article goes as far as Ripple CTO David Schwartz confirming that ODL spending on the EUR/USD pair increased by 1.5 million USD a day. In fact, David did not confirm this increase per se. A plausible explanation for the increased corridor volume is that XRP/USD and XRP/EUR order books are autobridged. David nevertheless reveals a no less interesting insight:

David comments that some customers also find ODL useful in efficient and liquid hard currencies. Ripple going after efficient corridors opens up a whole new playing field.

Hong Kong Exchange Taking Off With XRP

On May 23, GokuMarket, a decentralized marketplace for the blockchain economy, announces the addition of XRP with eight utilities:

It’s All Getting Connected

In her video on May 24, Crypto Eri shines with investigative journalism. She examines the background of Go2 Exchange, another Ripple client in Hong Kong that runs on Ripple.

In a nice piece of investigative journalism, Crypto Eri links the global payments platform with iRemit, MoneyMatch and UnionBank of the Philippines – which finally leads to Ripple ODL partner Coins.ph. There you go. It’s all getting connected.

U.S.-Mexico Corridor Approaches Critical Mass

At REIMAGINE 2020 on May 24, Ripple’s Director of Product Warren Anderson says that ODL by now handles more than 10 percent of the remittances between the U.S. and Mexico. According to Anderson, ODL in this corridor is no longer in the pilot stage, but is fully part of economic activity – meaning critical mass is within reach (critical mass, at which new technology explosively spreads, is said to be at 16 percent):

“So U.S.-Mexico is one of the largest remittance corridors in the world, and Ripple was seeing upwards of 10 percent of that flow actually going through our production network.”

Warren Anderson

Back in April, Ripple CEO Brad Garlinghouse announced the company’s XRP remittance platform processed $54 million worth of transactions from the U.S. to Mexico in the first week of February alone.

Binance Launches XRP Options Trading

On May 25, the world’s largest digital asset exchange Binance announces XRP options contracts on the exchange’s derivatives platform – one more tool by Binance to help increase market liquidity for XRP.

Ripple Again Calling on U.S. Regulators

On May 26, Ripple-CEO Brad Garlinghouse, not too active on Twitter these days anymore, tweets a cry for help:

Embrace crypto, Garlinghouse demands. Or risk falling behind China in terms of the unstoppable overhaul and technologization of the world’s financial system. Yet, the U.S. is fighting China on several fronts right now, just to mention Covid-19, the trade war, battle for Hong Kong, global claims to hegemony, you name it.

Just imagine what hub of financial industry innovation the United States of America could become by embracing, among others, modernized asset transfers. Yet, for now, the old system is fighting for its survival while politicians and bureaucrats defend the status quo.

Bitstamp Announces GBP/XRP Pair

Ripple ODL partner exchange Bitstamp on May 27 announces GBP trading. All of Bitstamp’s fiat currencies and cryptocurrencies will get an additional GBP pair, with zero trading fees through September 1, 2020, starting next week. Pairs includes USD, EUR, BTC, ETH, XRP, BCH and LTC.

Did Ripple CEO Silently Liquidate 67 Million XRP in 2017?

This is what an amended class-action lawsuit accuses Ripple’s CEO Brad Garlinghouse of. According to a Cointelegraph story published on May 27, Garlinghouse was presenting himself as bullish on XRP online while simultaneously liquidating his personal holdings.

The judge, however, requested that the plaintiffs explain the basis for their claims that Ripple made fraudulent claims concerning greater detail, citing several examples of the plaintiffs’ claims that were too general in scope.

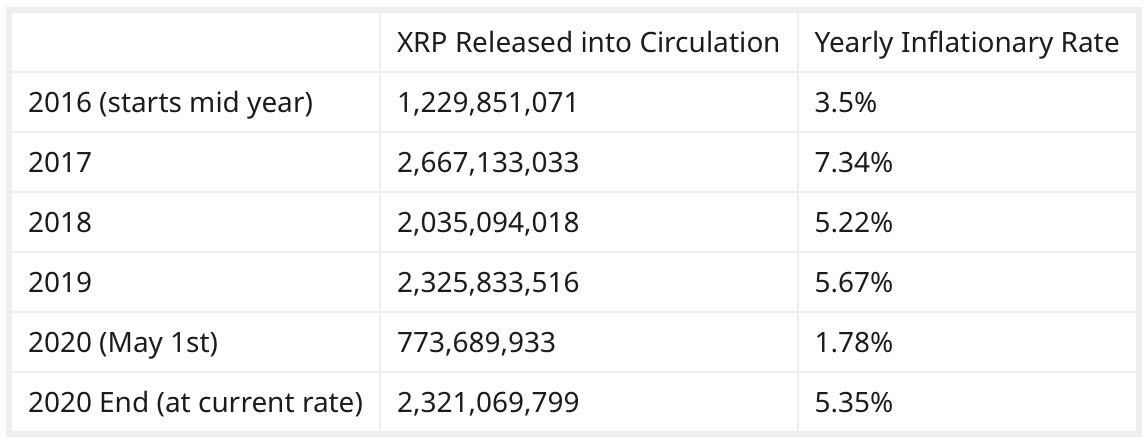

A Closer Look at XRP’s Seemingly High Inflation Rate

On May 27, an analysis posted on reddit examines XRP’s high inflation rate – this despite assurances by Ripple to keep token supply in check and create a healthy eco-system.

The author of the detailed analysis goes to great lengths to come to the following takeaways:

- (…) Ripple (…) obviously want us to believe that XRP is entering the broader market at a much slower rate than reality.

- Low sales numbers reinforce that notion, however an inflationary average of 5% isn’t as sexy.

- Ripple is doing lots with XRP that it doesn’t consider a “sale.” This gap will probably only widen with Ripple provided loans on the horizon.

- At the current rate of distribution, Ripple doesn’t need to dip into its escrow for another 2-3 years.

- Somebody (or somebodies) is receiving large amounts of XRP that they aren’t paying for. Ripple, if you’re reading this, sign me up for that program please!

FYI, known anti-Ripple portal Messari.io back on May 22 lists a much higher XRP inflation rate: whopping 20 percent!

Yet lest weforget: Even if 87.5 percent of Bitcoin’s maximum supply have been distributed, nearly a quarter of all Bitcoin hasn’t moved in five years and a few hands only control the largest Bitcoin wallets. It’s anyone’s guess how many Bitcoin are really in circulation, lost forever or locked up for who knows until when.

Harnessing Ripple’s Cloud Power

In a blog post on May 27, Ripple highlights the benefits of using RippleNet Cloud. Customers can go live on RippleNet five weeks faster than on-prem customers, the article says, and avoid hardware requisition or staffing to get started—speeding up payments for the end consumer.

“Consumers today are digital-first—for example, ordering an Uber and getting to their destination with a few taps on their phone—and expect their banking services to be as well. Unfortunately, today’s global payments infrastructure has more in common with the outdated postal system than with this generation’s need for speed. RippleNet’s Cloud solution provides banks and financial institutions with a new platform to meet these demands.”

Amir Sarhangi, Vice President of Product at Ripple

Mercury FX Promises Exciting ODL News

On May 28, Mercury FX creates some mystery. What’s about to come? Maybe, with Bitstamp adding GDP to their platform, after long silence finally a partner is here who can provide the required liquidity.

ODL Indexes Reach ATH

The liquidity index for the Bitso XRP/MXN corridor reaches an all time high on May 29, with a new ATH as well for BTC Market’s XRP/AUD corridor.

That’s it for this XRP and Ripple Weekly Report. Tune back in for the next XRP Weekly Report, published on June 5, 2020.

If you like what you read, sending a tip to XRP address rLHzPsX6oXkzU2qL12kHCH8G8cnZv1rBJh tag 3130998845 is most welcome! 🙏

+++ Please get in touch if you’d like to share XRP and Ripple news or related rumors, inputs, insights.