XRP Weekly Report June 19, 2020 – Are 3 of Thailand’s Top 5 Banks RippleNet Users?

So much we don’t see that is going on in the background while Ripple slowly and steadly weaves its network web across the globe. One unnoticed news: RippleNet-powered Nium a.k.a. InstaReM facilitates cross-border payments for Kasikornbank, one of Thailand’s top 5 banks.

Ripple’s top exec Marcus Treacher recently said that through a number of RippleNet members like Singapore-based Nium, which is an aggregator like Earthport, Ripple can touch many places. Besides Thailand’s Siam Commercial Bank (SCB) that would make two major bank heavyweights in the kingdom who are RippleNet users.

Wait, there’s a third one: Bank of Ayudhya, branded and commonly referred to as Krungsri, a Thailand-subsidiary of Japan’s massive MUFG Bank, which in 2017 joined the consortium of SBI Ripple Asia and pilot-tested RippleNet… that’s three out of Thailand’s top five banks surfing the Ripple wave.

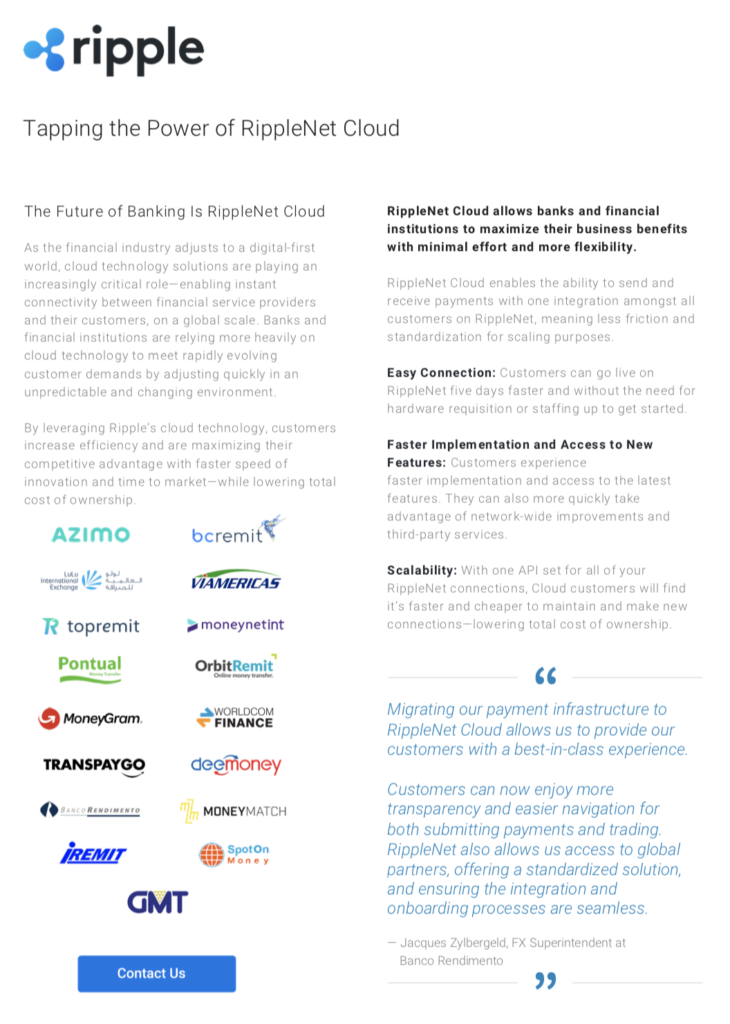

And, at this point, a big thanks to a never failing community and the untiring Leonidas Hadjiloizou of XRP Arcade.com, treasure trove of XRP news, who unearthes many gems – like this this one-pager by Ripple posted in June, revealing five new customer names and 17 already using RippleNet Cloud.

The uptake in RippleNet cloud usage demonstrates how Ripple is picking up momentum at increased pace – for a long time against many odds. Logic now would suggest that the vast supply of XRP locked up in escrow gets picked up by monthly buyers. This usage might finally reflect on price and kickstart the token value.

Now here’s the list of events that got noticed during the course of last week – and to warm you up, why not with a quote by Ripple’s Marcus Treacher. Asked, what the largest value is Ripple can transmit, he says: “Infinite.”

XRP Market Overview

The call in the XRP Weekly of June 5 to set an XRP buy order around $0.19, while XRP was hovering above $0.205, wasn’t too wrong. My guts feel an impulse is incoming. XRP on June 11 nearly wicked the moon line at $0.182. Patience and hold. Crunch time approaching. It’s no longer a matter of months.

$33.9 Billion Market by 2026 – How Big a Piece of the Global Remittances Cake Will Ripple Cut Off?

According to a growth trend forecast published on June 3, the global digital remittance market will grow at an annual average of 17.2 percent, reaching $33.9 billion by 2026. Time for haters running out while Ripple eats the cake.

Ripple Confirms Brazilian ODL Corridor

In an interview with Future of Finance published on June 8, Marjan Delatinne, Head of Global Banking at Ripple, confirms the Brazilian ODL corridor will be up and running soon.

Delatinne explains that Brazil is at the heart of Ripple’s business strategy for Latin America and that the company is currently actively working on the development of an ODL and thus XRP-based payment corridor for the country. When describing the advantages of ODL compared to the traditional nostro / vostro system, Delatinne says:

We extend these services now to more and more corridors typically exotic corridors with lots of challenges, like the Philippines and very soon within Brazil, so let’s say there is a big agenda and roadmap on that.

BitPay’s Prepaid Mastercard Makes Using XRP Easy

Blockchain payments provider BitPay has launched a Mastercard prepaid card for crypto users in the United States, Cointelegraph reports on June 11. The BitPay Card enables customers to convert their cryptocurrency into fiat, which can then be loaded onto the card and spent anywhere Mastercard debit is accepted. BitPay Card supports Bitcoin (BTC), Bitcoin Cash (BCH), Ether (ETH), XRP and stable coins including USDC (USDC), GUSD, PAX and BUSD.

RippleNet Saves Saudi Arabia’s Central Bank Up to $400 Billion per Year

Saudi Arabia’s Monetary Authority (SAMA) has drastically cut down on costs, saving up to $400 billion a year following its decision to upgrade and modernize its payments system to Ripple’s xCurrent. In a reference posted on June 11, Saudi Arabia’s central bank is quoted as saving up to up to $400 billion a year through RippleNet, which at this stage does not include ODL services in real-time.

Trump’s New Top Banking Regulator Is Bullish on Crypto

Former Ripple Chief Marketing Strategist Cory Johnson might be a bit biased as far as XRP is concerned. In a Forbes article published on June 11, Cory interviews Brian Brooks. former head of Coinbase’s legal department, who has been appointed head of the new U.S. Office of the “Comptroller of the Currency” (OCC).

“Interestingly, he’s looking for decentralized networks in general”, the article says. “He cited Bitcoin, Ether and XRP in particular – to solve many of the problems hindering more than one-thousand financial institutions under his purview.”

In his “regulation proposal” of June 2, Brooks advocates a revision of the existing regulations on “digital assets of banks.” In particular, Brooks also expressed concern about the antiquated methods used by banks to transfer money.

It takes three days if you’re trying to send money from the US to Europe… on the Swift network. Your money is at risk during that period. And even when the money is transmitted, foreign exchange fees are incurred. But a digital representation of value on both sides of the transaction can eliminate that friction and those costs.

Doesn’t this sound familiar. There’s no confirmation Ripple whispered this in Brooks’ ear.

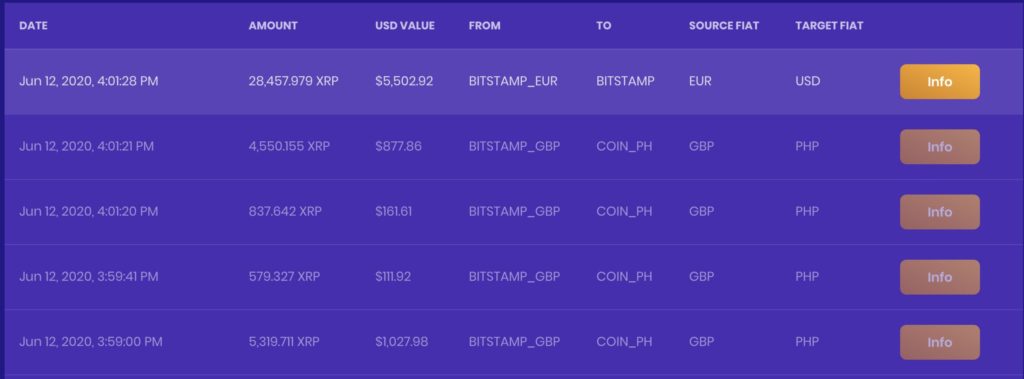

Increased Activity Spotted on New GBP/PHP ODL Corridor

Observed by long-time XRP proponent @TeholBeddictXRP on June 12, there’s some activity on the ODL corridor between the U.K. and the Philippines via Bistamp and Coins.ph exchanges:

Digital money transfer service Azimo meanwhile confirms using ODL for the GBP/PHP corridor.

ODL Corridors Still Depressed After Hard Reset

ODL corridors show signs of volume recovering after Ripple’s amendments the other week. The XRP/EUR liquidity on June 14 seems back on track to a reversal of the downwards trend.

Bitso’s XRP/MXN corridor is still substantially down while Coins.ph’s XRP/PHP as well as BTC Markets’ XRP/AUD corridors seem on a fragile path to recovery.

Overall, most ODL corridors don’t yet seem to stabilize and are still way down from previous highs. I wouldn’t be surprised though if Ripple somehow manages to mask ODL metrics. Which client wants to see business details out in the public open?

Bye-Bye Swift!

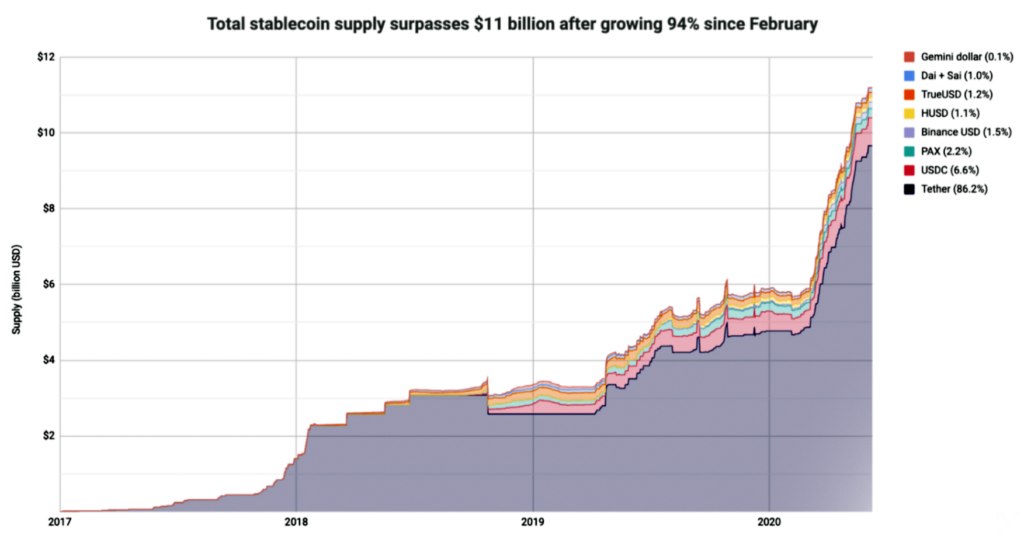

While not directly related to Ripple and XRP, this is no less interesting. Liechtenstein’s Bank Frick drops Swift, which faces competition that will only get more intense as cryptocurrencies and stablecoins get more traction.

The “crossover finance” bank will now use the USDC stablecoin to power cross-border transactions. Currently, stablecoins are the fastest growing segment of crypto, according to an op-ed by Daily Fintech published on June 15. In just two months, global stablecoin assets in circulation grew by 70 percent.

Make no mistake, XRP is still needed in a world of stablecoins. Read Galgitron‘s in-depth analysis. Key excerpt:

The common misconception is that stablecoins are going to eliminate all of the problems related to cross-border payments, but stablecoins are merely just faster versions of the underlying fiat. They don’t inherently generate liquidity, they don’t create new pairings / corridors, but most importantly, they don’t eliminate nostro / vostro. Sure, stablecoins could eliminate the need for country A to have foreign assets in a bank account in country B, but that just means country A would need to hold those foreign funds themselves, and would need to do so for each country.

Media Giant Condé Nast Monetizes With Coil

More than 144 million readers of Condé Nast, the 111-year-old global media company, are invited to monetize the media giant with the Ripple-backed online payment platform Coil.

This development is popped on June 14 by Eric Dadoun, a tech startup investor and crypto enthusiast.

XRP Arcade did a check, thus more than a dozen other Condé Nast U.S. publications are also Web-monetized with Coil – among them notable brands: allure, Bon Appétit, epicurious, Glamour, Teen Vogue, Self, Pitchfork, GQ Style, GQ.com, Them, The New Yorker, Vanity Fair and Vogue.

BTW, joining Coil to support dedicated publications doesn’t cost you an arm and a leg. The flat rate of $5 a month is a welcome contribution to support quality sites that work for and believe in the future of this unobtrusive Web monetization. If you haven’t done yet so, why not join – and small droplets also support this XRP Weekly.

Ripple’s Marcus Treacher Spills the Beans: Complete Global Coverage by Mid-2021

Marcus Treacher, Senior Vice President of Customer Success at Ripple, in a fireside chat published on June 15 delivers fascinating insights about what Ripple is up to in the medium and longer term.

Ripple is building an ecosystem from scratch without any relying on legacy systems, Marcus says, which explains the network’s impact. He also mentions China expansion plans – Ripple is ready to move forward, first though the “geopolitical situation needs to soften”.

Ripple is not after taking out Swift, he says, yet for the Society for Worldwide Interbank Financial Telecommunication there seems no way out in the long run. Marcus:

Ultimately, what Ripple is doing, will fundamentally affect the market Swift is working in. That’s just how innovation works and how disruptive change works in the marketplace.

Marcus’ key statement about global coverage and the MoneyGram factor:

Our network is only as big as the customers that we connected to and clear through so right now we clear directly in 45 countries. Through a number of RippleNet members like Nium, for example, with a head office in Singapore, who are aggregators like Earthport, for example, we can touch many many other countries. The way we’re heading I would think by mid-2021 we’ll have, to intensive purposes, complete global coverage. We do have a great pipe into MoneyGram, which we have a relationship with, which gives us a cash payout in virtually every country in the world and we’re looking to build that up and plug that into the RippleNet network this year.

Oh, and what’s the largest value Ripple can transmit? “Infinite,” Marcus says.

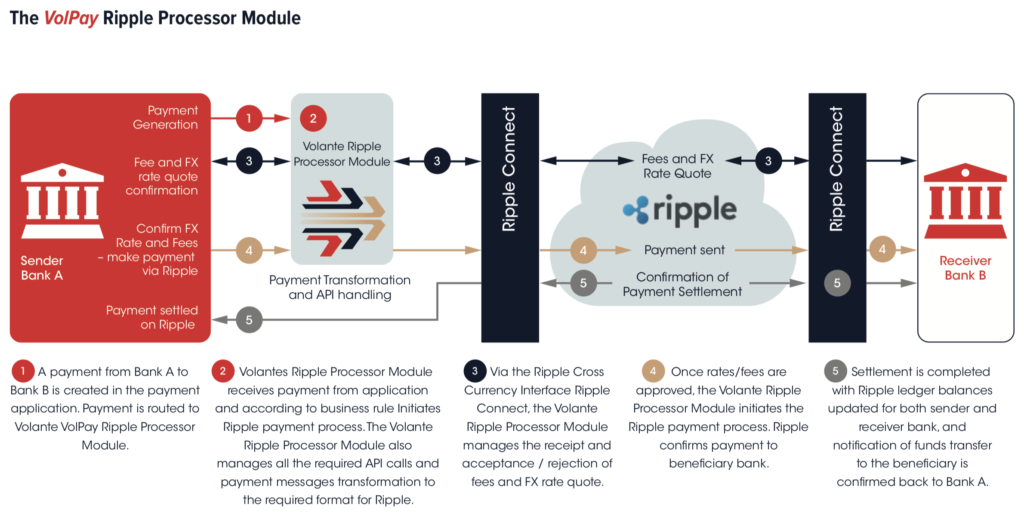

U.S. Bank Integrates Volante’s Ripple Global Settlement Network

Announced on June 15, First American Trust, a U.S. banking solutions provider, selects Volante cloud solution to replace the bank’s legacy wire transfer system.

Volante Technologies provides services to accelerate digital transformation and modernization in financial services. Volante offers VolPay processor module which simplifies the connection to Ripple’s near realtime payment and settlement network. Find more information here.

And some XRP ODL icing on the cake:

Solid Uptake Validates Future of Cloud-Based Banking

Since its launch, 30 percent of all RippleNet payments go through RippleNet’s cloud solution. Ripple’s top executive Marcus Treacher tweets on June 15:

Ripple in CNBC’s 2020 List of Top 50 Disruptors

Ripple makes it into the 2020 CNBC Disruptor 50 companies, published on June 16.

In 28th place as “a crypto answer to money transfer,” Ripple joins this exclusive list of “private companies whose breakthroughs are influencing business and market competition at an accelerated pace. They are poised to emerge from the coronavirus pandemic with tech platforms that have the power to dominate.”

Tellingly, first place is taken by Stripe, the global e-payments company which is “unlocking the lockdown’s biggest value.”

Big Upvote by Crypto Influencer for RippleNet Cloud

Crypto expert and ambassador Sydney Ifergan, who among many other achievements is Honorary Advisor of Hong Kong International Blockchain Association, on June 16 gives his 16k Twitter followers a big upvote for RippleNet Cloud:

Former CFTC Chairman Says XRP Isn’t a Security

Bummer really that Chris Giancarlo is no longer the chairman of the Commodity Futures Trading Commission (CFTC). According to a paper released by the the honorable International Financial Law Review on June 17, Giancarlos says that “ultimately, under a fair application of the Howey test and the SEC’s presently expanding analysis, XRP should not be regulated as a security, but instead considered a currency or a medium of exchange.”

The increased adoption of XRP, Giancarlo goes on, as a medium of exchange and a form of payment in recent years, both by consumers and in the business-to-business setting, further underscores the utility of XRP as a bona fide fiat substitute.

For transparency’s sake we have to add that Giancarlo is now at a law firm providing counsel to Ripple, calling the impartiality of such claims into question. Right at the bottom of the report, a footnote states that Willkie Farr & Gallagher, for whom Giancarlo works as a senior counsel, also provides counsel to Ripple. Let’s hope Ripple is not shooting itself in the foot with this paper.

BCRemit About to Board ODL

U.K.-based online money transfer service BCRemit on June 18 confirms they’re in the early stages of Ripple ODL adoption – thank you Crypto Eri for the shout. BCRemit’s stronghold is the U.K. to the Philippines corridor.

Ripple Aims to Make XRP Palatable to India

In a recommendation paper released on June 18, Ripple touts XRP use in new crypto framework suggested for India:

Ripple Supports Global PayID Network

Ripple on June 18 announces to support the global PayID payment network with 40+ partners, allowing users to send digital payments across different platforms.

This is about focus on retail and making the use of digital and fiat easier. Hear what the man himself, Ripple CEO Brad Garlinghouse, on CNBC has to say about PayID – and disruptors:

That’s it for this issue. Next XRP Weekly is published on June 26, 2020. Stay tuned!

If you like what you read, sending a tip to XRP address rLHzPsX6oXkzU2qL12kHCH8G8cnZv1rBJh tag 3130998845 is most welcome! 🙏

+++ Please get in touch if you’d like to share XRP and Ripple news or related rumors, inputs, insights.